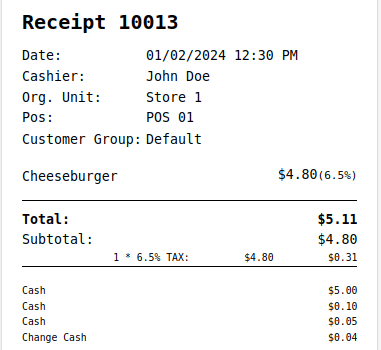

To clarify how taxes are calculated on your receipts, let us look at an example:

Initial situation: You have 5 items. Each of these items has a net price of $0.99 and is taxed at a rate of 19%, each of which corresponds to a gross amount of $1.18 ($0.99 * 1.19 = $1.1781 rounded to $1.18). There are two legally accepted procedures to calculate the value-added tax:

- The net amounts are added together on the receipt, and the tax is then applied to the sum: ($0.99 * 5) * 1.19 = $5.8905 rounded to $5.89.

- The tax is calculated based on the posting method, rounded, and then added together: ($0.99 * 0.19) * 5 = $5.90

The checkout uses the first method. Which typically makes things easier for taxes and accounting. Most tax collection agencies will take a gross total and multiply that by the tax rate. Using the first method will typically match up with what the reporting agency expects. When you have items with multiple tax rates, the items are grouped together, and that amount is rounded per tax rate.

To get full directions on how to set up your taxes, please refer to our Tax Set Up Page.