Follow the steps below to configure the taxes for your business completely.

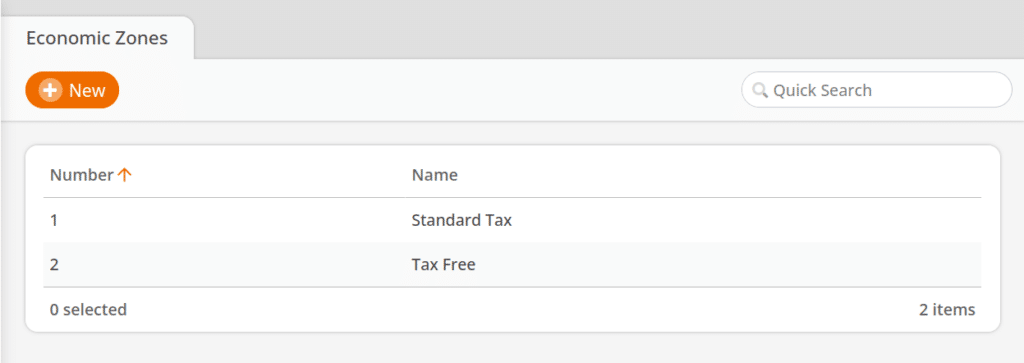

1. Set up all Economic Zones

Economic Zones are the geographical area(s) where your business(es) operate and can be distinguished by their unique tax rates and requirements (i.e., counties, cities, states, countries).

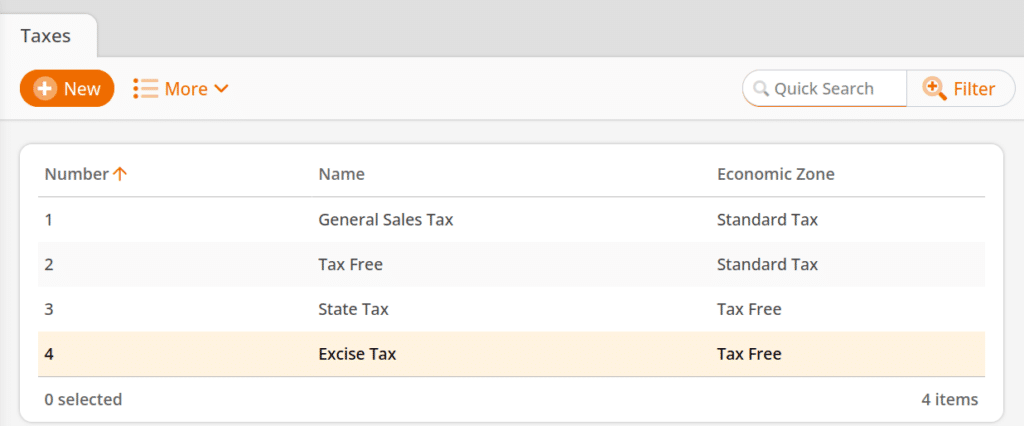

2. Set up all Tax Rates

Tax rates are the individual taxes applied to products or services sold (i.e., county sales tax, state sales tax, liquor taxes, etc.).

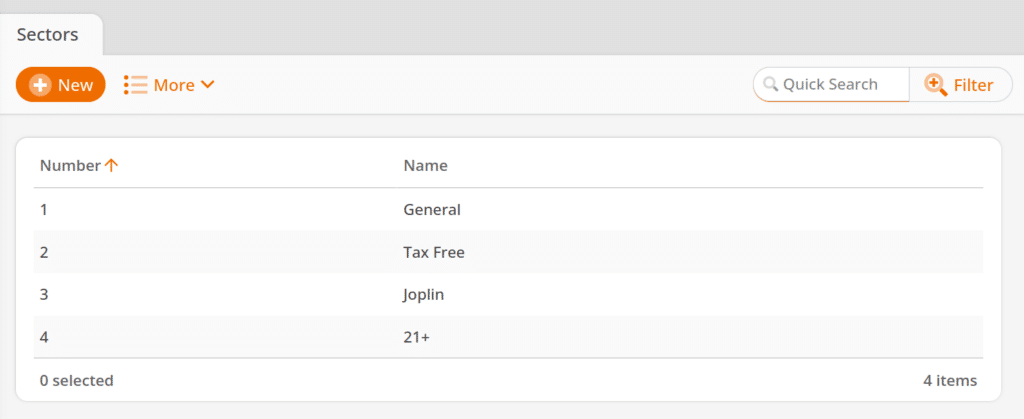

3. Create Sectors

Sectors are a way to group products by similar taxation requirements (i.e., products that are tax-free can be placed in a tax-free sector, products that receive a general sales tax, liquor products, etc.).

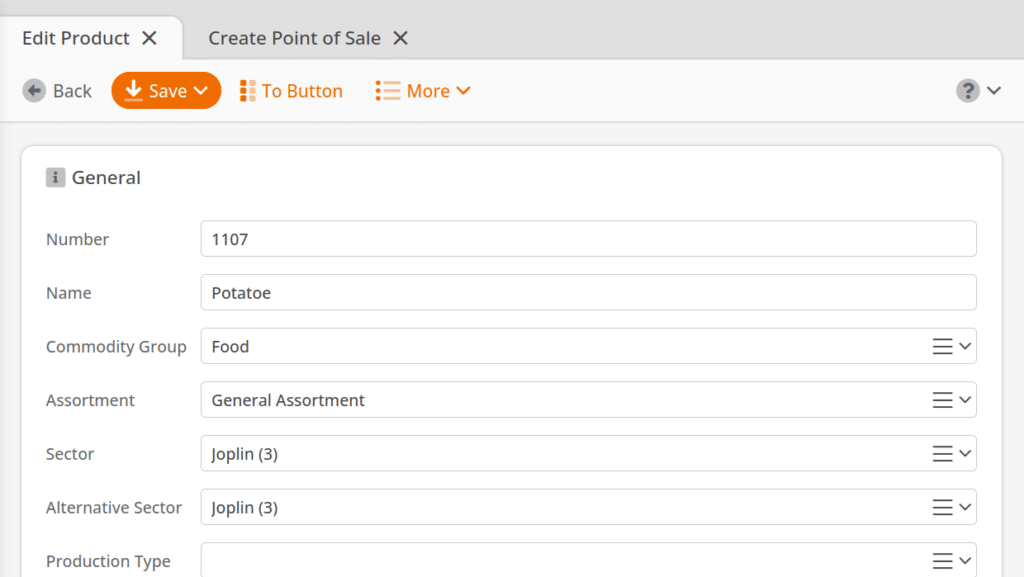

4. Assigning Sectors to Products

When you create your products, select the appropriate sector (i.e., a set of applicable tax calculations), and if needed, you may also select an alternate sector for products whose taxation may vary depending on the situation.

To mass apply a tax sector to products, Filter your products by the desired filter (Commodity Group, Assortments, etc.). Click the Edit button.

On the Edit Product page, locate the Sector and Alternative Sector drop-down menus on the right-hand side. There, you may select the appropriate tax to be applied to all products within that filter. Once done, click Save.

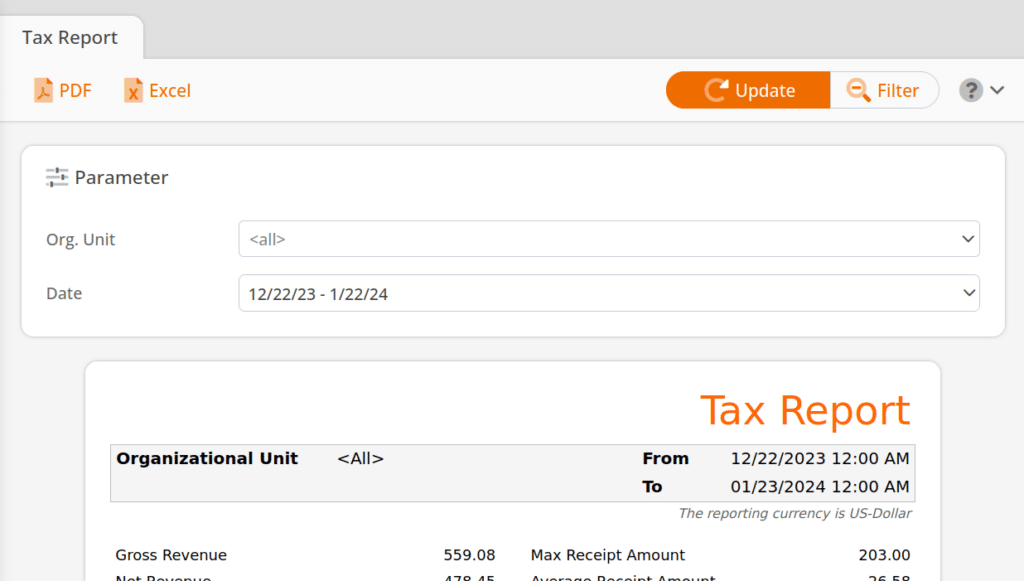

Net revenue, gross revenue, and amounts incurred may be viewed in the Tax Report.

Understanding Tax Rulings at the Point of Sale

- Products belong to Sectors.

- Economic Zones belong to Customers and Organizational Units.

- The Product looks at its Sector first, and then the Economic Zones inside of that Sector, and makes a decision for what Tax Rate to use.

- Points of sale are assigned to Organizational Units, and based on what Organization Unit the point of sale is assigned to and what Economic Zone is attached to that Organizational Unit. The point of sale calculates the relevant Tax Rate.

- The only way to override that default Economic Zone is to have a Customer assigned to the receipt wherein the Customer belongs to a different Economic Zone. In that instance, the customer’s settings will take precedence on that receipt instead of the point of sale settings.

With this understanding, it is easy to configure tax-exempt customers or customers with special tax rulings.