Economic Zones are the geographical areas where your business operates. They distinguish unique tax rates and requirements (i.e., counties, cities, states, countries). You may create as many Economic Zones as you need to cover each unique tax area under which your business falls.

Tax Set Up: Economic Zones

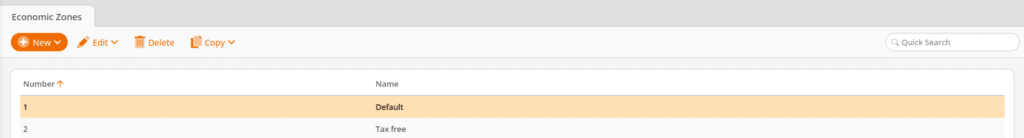

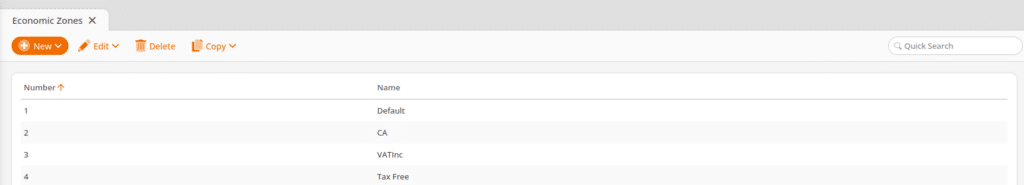

Create Economic Zones:

Navigate to Settings > Economic Zones. Use the +New button to add as many Economic Zones as you need, giving them descriptive names that will help you to identify them later. Edit (i.e. rename) an existing Economic Zone by selecting the item from the list. Then click the Edit button above.

Delete an existing Economic Zone by selecting the item from the list. Then click the Delete button above.

Copy duplicates an existing Economic Zone.

Using Multiple Economic Zones

If you only have one location or all of your locations utilize the same tax regulations, then you only need to create one economic zone.

For example, if you have multiple stores, but they are located in the same county, where all applicable tax rates and regulations are the same for each store, these would fall under one Economic Zone. If your business operates out of multiple locations where the tax rates and regulations may vary, then create an Economic Zone for each unique area.

NOTE* It is possible to have multiple locations within one Economic Zone.

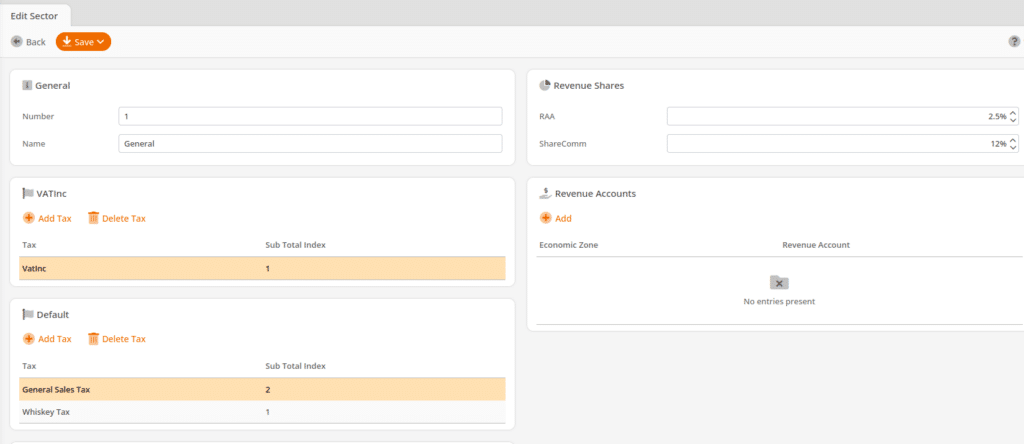

If your locations utilize different tax regulations, you would set up an economic zone for each. Then, under Tax Set Up, you will add each tax rate and choose the relevant Economic Zone for each rate.

When you add the Tax Rates to the Sector, the Economic Zone you have indicated above will apply only to that Economic Zone assigned to the Organizational Unit. Remember that Sector applies to products, and Economic Zones and Organizational Unit apply to where those products are sold or to whom they are sold.

For example, if you have multiple stores, but they are located in different counties/states, where all applicable tax rates and regulations are different for each store, these would fall under multiple Economic Zones.

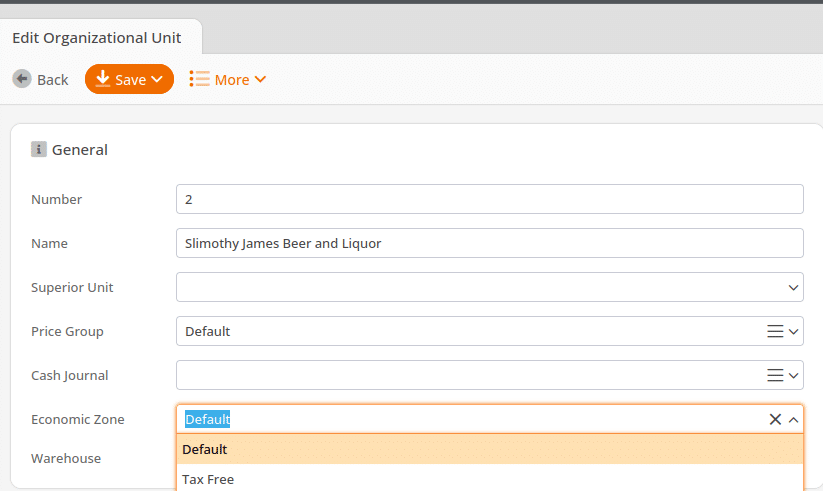

Assign Economic Zones

In order to assign an Economic Zone, go to Settings > Organizational Units and assign the appropriate Economic Zone for each Organizational Unit. After Retrieving Master Data ,each point of sale will charge the appropriate tax rate for the Economic Zones assigned to its organizational unit.

See the Tax Set Up page for a full list of instructions to get your taxes set up.