This is where you may set up each individual tax rate, as necessary, which is applicable to the products you are selling. You will need to set up as many taxes as you are going to collect at the point of sale. This can range from just one tax to several depending on local taxing legislation.

Please refer to our Tax Set Up manual page for a full list of instructions to get your taxes set up.

Setting up Taxes

Before you set up your taxes, you will want to set up an Economic Zone. To learn how to do so, please refer to our Economic Zone manual page.

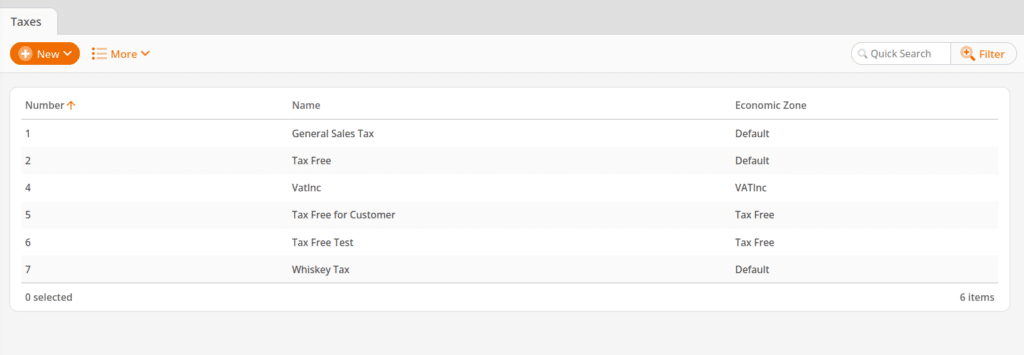

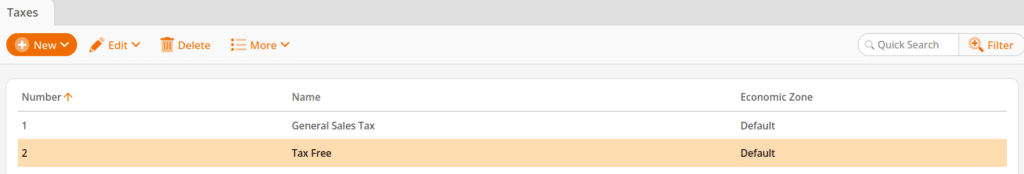

You can configure taxes for your point of sale system by navigating to Settings> Taxes. Here, you will be able to create a New tax and Edit or Delete existing taxes. You may even Copy an existing tax for a quicker setup process. From the …More drop down menu you may view your Tax Report.

Each tax is given a name, assigned to an economic zone, and determined to be inclusive or exclusive. The rate and date of validity must also be defined.

By default, all tax rates will be exclusive unless the box for “Included” is checked. If you enable the option “Included,” the POS will calculate the tax under the assumption that the tax is included in the retail price. This means the total will not increase for the customer. However, the net revenue will decrease for your business. This setting usually makes sense if including the tax is required by the local government or for cash-only businesses that do not want to avoid dealing with change.

Each tax applies to one economic zone.

Upcoming tax rate changes may be set in advance using the valid from date.

After the tax rates have been set, you should proceed to set up the Sectors.

Multiple Tax Rate Set-Up

If you have taxes that need to be broken out instead of cumulatively listed, you can do this under Taxes as well. You can make multiple Tax Rates for the same Economic Zone to help accomplish this.

Here’s an example: Your county charges a 5% liquor tax and a 5% county tax. In some municipalities, they may be fine seeing a total tax of 10% shown on the receipt.

In other situations, they may wish to see what percentage belongs to what particular tax. If that is the case, you could make one tax for liquor and one tax for county, and then by adding them to the same Sector, both would apply.