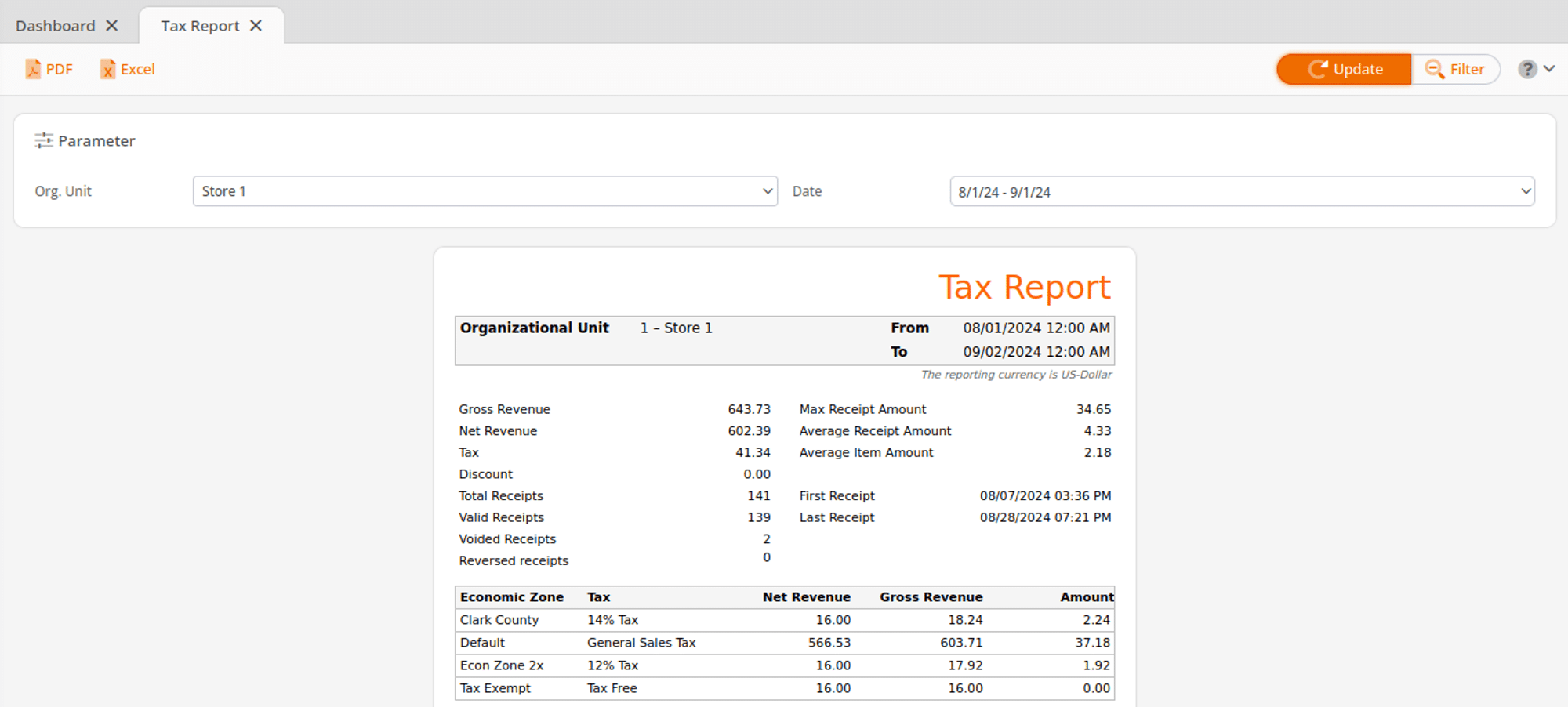

The Tax Report shows the generated sales tax per economic zone.

Each tax rate is allocated to an economic zone (i.e., different cities, states, or customer-specific economic zones).

This report will show you gross and net revenues, total tax collected, and other useful information.

It is important that the transactions considered belong to the same organizational unit.

For help setting up taxes for your business, please refer to our Tax Set Up manual page.

The Tax Report is located under the Evaluations tab. If you can not locate it there, you must Edit Menu Entries. This report may be filtered by Organizational Unit, and Date.

Once you have selected the organization unit you wish to view, click on Update. A report will be generated for that store.

If you want to export a copy of this report in either PDF or Excel format, click the respective buttons.

Tax Report Figures Guide

- Gross Revenue: Revenue including taxes

- Net Revenue: Revenue without taxes

- Tax: Total amount of tax owed/paid

- Discount: Total amount of discounts applied

- Total Receipts: Amount of receipts performed in the report timeframe

- Valid Receipts: All receipts that were finalized

- Voided Receipts: Counts any voided receipts

- Max Receipt Amount: The highest amount paid on a receipt from this report

- Average Receipt Amount: The average amount paid across receipts from this report

- Average Item Amount: The average price calculates off all items sold from this report

- First Receipt: Time of first receipt used to gather data for the report

- Last Receipt: Time of last receipt used to gather data for the report

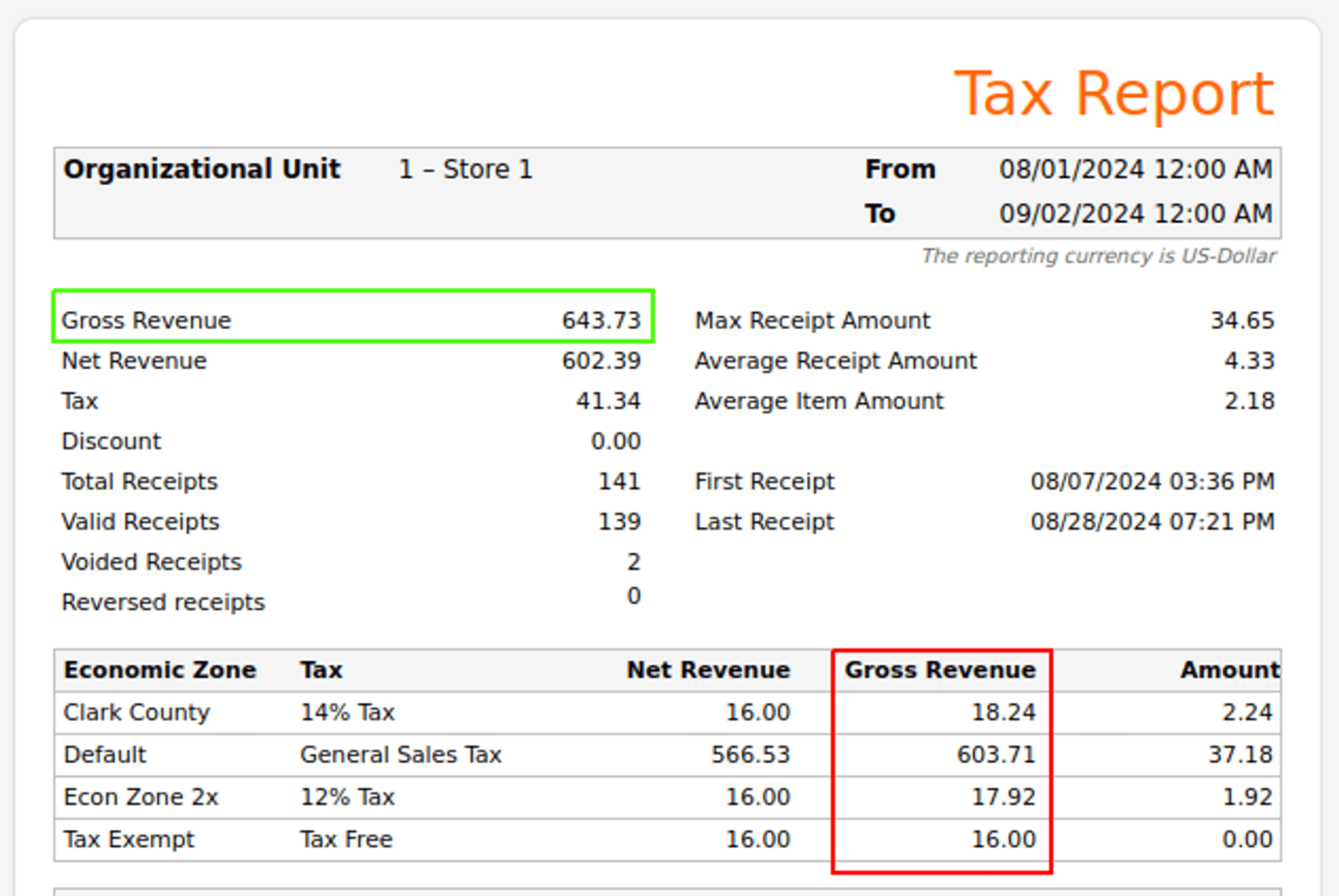

*Note below: Your Gross Revenue is the number in the green box. The amounts under the Gross Revenue column in the red box are the amount each tax percentage was applied to. Adding up the numbers in that column does not equal your gross revenue.

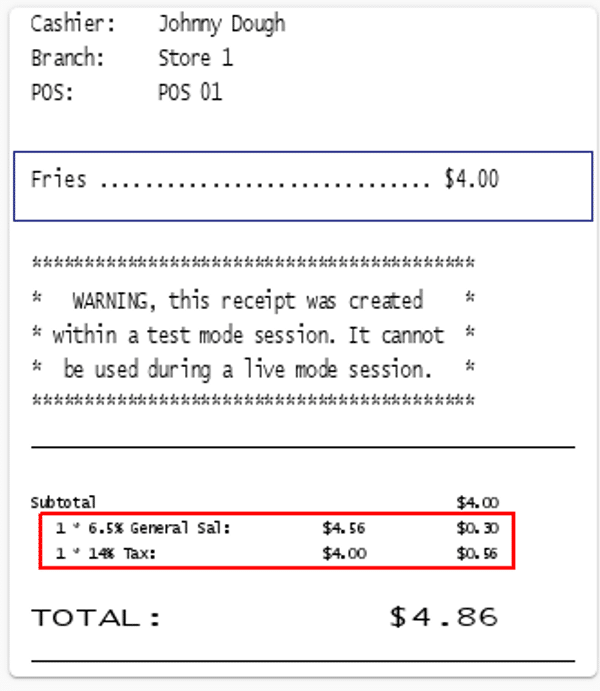

For example, you can see the 6.5% and 14% taxes being applied to the $4.56 and $4.00 in the receipt. The $4.56 and $4.00 would be included in the Gross Revenue column in the Tax Report for each tax (so they would show up twice), but this does not mean $8.56 was made in revenue.